Austin, Texas stands as one of America’s most dynamic and rapidly growing metropolitan areas, attracting thousands of new residents each year with its vibrant music scene, thriving tech industry, and unique cultural blend. However, beneath the city’s undeniable charm lies a complex real estate market that can challenge even the most prepared homebuyers. As of May 2025, Austin’s housing market is experiencing a significant correction phase, with active residential listings reaching 15,796 units—a 21% increase compared to the previous year—while the median sales price has settled at approximately $450,000, down 3.2% year-over-year.

This market transformation presents both opportunities and pitfalls for prospective homebuyers. The days of frenzied bidding wars and instant offers are largely behind us, replaced by a more balanced market where buyers have increased leverage and more time to make informed decisions. However, this shift also means that the stakes for making the right choices have never been higher. With mortgage rates hovering around 6.8% for a 30-year fixed loan and property taxes in Austin representing the highest percentage of monthly housing costs in the nation at 19.8%, every decision in the homebuying process carries significant financial implications.

Austin’s unique characteristics as the only major urban center in Texas built on a floodplain, combined with its position in the heart of “Flash Flood Alley,” create specific challenges that buyers in other markets simply don’t face. Add to this the city’s notoriously high property tax rates, rapid infrastructure changes due to explosive growth, and a competitive market still influenced by major investment groups, and it becomes clear that successful homebuying in Austin requires more than just general real estate knowledge—it demands an understanding of the city’s specific nuances and potential pitfalls.

The current market conditions, while more favorable to buyers than in recent years, still require careful navigation. With months of inventory at 5.65—well above the neutral threshold of 4.0—and the New Listing to Pending Ratio dropping to just 0.53, buyers have more choices but also face the challenge of making decisions in an environment where market dynamics are rapidly evolving. The Activity Index sitting at 23.9% reflects a noticeable decline in the rate at which homes are going under contract, signaling that while opportunities abound, the window for securing the right property at the right price requires strategic timing and informed decision-making.

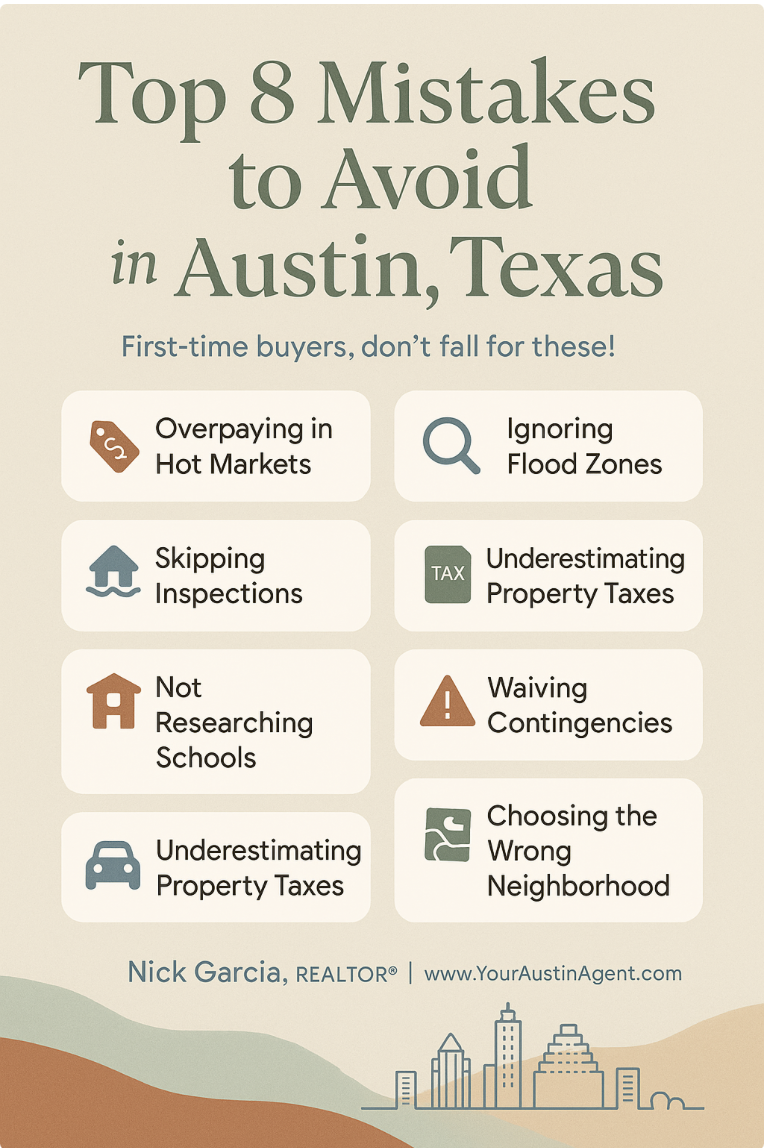

This comprehensive guide examines the eight most critical mistakes that homebuyers in Austin must avoid to ensure their real estate investment serves them well both in the short term and for years to come. Each mistake outlined here has been identified through careful analysis of current market conditions, local real estate patterns, and the unique challenges that define Austin’s housing landscape in 2025.

Mistake #1: Shopping for Homes Without Mortgage Pre-Approval

Perhaps no single error proves more costly or frustrating for Austin homebuyers than beginning their house hunt without securing mortgage pre-approval. In today’s market environment, where sellers receive multiple offers even in a cooling market, attempting to compete without pre-approval is akin to entering a race without proper equipment. The consequences extend far beyond mere inconvenience, often resulting in missed opportunities, wasted time, and ultimately, settling for less desirable properties or paying premium prices.

The current Austin market dynamics make pre-approval even more critical than in typical real estate environments. With 15,796 active listings available as of May 2025, buyers might assume they have unlimited time to explore options and secure financing later. However, this assumption proves dangerous when considering that desirable properties in well-located neighborhoods still move quickly, and sellers continue to prioritize buyers who demonstrate serious intent and financial capability through pre-approval documentation.

Pre-approval differs significantly from pre-qualification, a distinction that many first-time buyers fail to understand until it costs them their dream home. Pre-qualification involves a basic review of financial information provided by the buyer, often conducted over the phone or online, resulting in an estimate of borrowing capacity. Pre-approval, conversely, requires comprehensive documentation including tax returns, pay stubs, bank statements, and credit reports, followed by underwriter review that produces a conditional commitment for a specific loan amount. This distinction becomes crucial when competing against other buyers, as sellers and their agents recognize pre-approval as a genuine indicator of a buyer’s ability to close the transaction.

The financial landscape of 2025 adds another layer of complexity to the pre-approval process. With 30-year fixed mortgage rates at approximately 6.8%, significantly higher than the sub-3% rates available just a few years ago, many potential buyers discover that their purchasing power has diminished substantially. A buyer who could afford a $500,000 home with a 3% interest rate might find their budget reduced to $400,000 or less at current rates. Discovering this limitation after falling in love with properties outside their actual price range creates emotional and financial stress that proper pre-approval would have prevented.

Austin’s unique market characteristics further emphasize the importance of early pre-approval. The city’s high property tax rates, which represent 19.8% of the average homeowner’s monthly housing costs—the highest percentage in the nation—significantly impact the total monthly payment calculation. Many lenders factor property taxes into their debt-to-income ratio calculations, meaning that Austin buyers often qualify for lower loan amounts than they might in markets with more reasonable tax burdens. Understanding this limitation early in the process allows buyers to adjust their expectations and search parameters accordingly.

The pre-approval process also reveals potential credit issues or documentation problems that could delay or derail a purchase. In Austin’s fast-moving market segments, having 30 to 45 days to resolve credit disputes or gather additional documentation can mean the difference between securing a desired property and losing it to a more prepared competitor. Common issues uncovered during pre-approval include errors on credit reports, insufficient documentation of self-employment income, or complications related to recent job changes—all problems that can be addressed proactively rather than reactively.

Furthermore, the pre-approval process provides buyers with leverage in negotiations, particularly important in Austin’s current market where sellers have become more selective about offers. A pre-approval letter demonstrates not only financial capability but also serious intent, often influencing sellers to consider offers from pre-approved buyers more favorably than higher offers from unqualified prospects. This advantage becomes particularly valuable when competing for properties in desirable neighborhoods like Zilker, South Austin, or the emerging areas east of I-35, where multiple offers remain common despite overall market cooling.

The mortgage landscape in Austin also includes various loan programs that require early exploration and pre-approval. Texas offers several first-time homebuyer programs, including the Texas State Affordable Housing Corporation’s programs and local Austin initiatives designed to assist with down payment and closing costs. These programs often have limited funding and specific qualification requirements that necessitate early application and pre-approval. Additionally, given Austin’s flood-prone geography, some properties may require specialized financing considerations that only become apparent during the detailed pre-approval process.

Smart Austin homebuyers should begin the pre-approval process by consulting with multiple lenders to compare rates, terms, and fees. The difference between lenders can amount to thousands of dollars over the life of a loan, making this comparison shopping essential. Local credit unions, regional banks, and national lenders all serve the Austin market, each with different strengths and specializations. Some lenders may have more experience with Austin’s unique challenges, such as properties in flood zones or homes with unusual construction types common in the city’s older neighborhoods.

The pre-approval timeline typically requires two to three weeks for completion, though complex financial situations may extend this period. Austin buyers should initiate this process well before beginning their house hunt, allowing time to address any issues that arise and to shop for the best lending terms. The pre-approval letter typically remains valid for 60 to 90 days, providing a reasonable window for house hunting while ensuring that financial information remains current and accurate.

In Austin’s evolving market, where inventory levels continue to rise but desirable properties still attract multiple interested buyers, pre-approval serves as both a practical necessity and a strategic advantage. Buyers who skip this crucial step often find themselves relegated to less desirable properties, forced to make hasty decisions, or ultimately priced out of neighborhoods they could have afforded with proper preparation and documentation.

Mistake #2: Underestimating the Total Cost of Homeownership in Austin

One of the most financially devastating mistakes Austin homebuyers make involves focusing exclusively on the purchase price and monthly mortgage payment while overlooking the substantial additional costs that define homeownership in this unique market. Austin’s cost structure differs dramatically from other major Texas cities, with property taxes, insurance requirements, and maintenance costs that can add hundreds or even thousands of dollars to monthly housing expenses. Buyers who fail to account for these costs often find themselves house-poor, struggling to maintain their lifestyle while meeting their housing obligations.

Austin’s property tax burden stands as the most significant hidden cost that catches new homeowners off guard. According to recent analysis by the Austin Business Journal, property taxes in the Austin area represent 19.8% of a homeowner’s monthly housing bill—the highest percentage in the entire United States. To put this in perspective, a homeowner with a $450,000 property (Austin’s current median price) can expect annual property taxes of approximately $8,500 to $10,000, translating to $700 to $850 per month in addition to their mortgage payment. This figure often shocks buyers accustomed to markets where property taxes represent a much smaller portion of housing costs.

The complexity of Austin’s tax structure adds another layer of challenge for prospective buyers. Properties in Austin may be subject to multiple taxing entities, including the City of Austin, Travis County (or other counties for properties outside Travis County), Austin Independent School District or other school districts, Austin Community College District, and various municipal utility districts or special purpose districts. Each entity sets its own tax rate, and the combined rate can vary significantly depending on the property’s exact location. A home in central Austin might face different tax obligations than a similar property in Cedar Park or Round Rock, even though both are considered part of the greater Austin metropolitan area.

Insurance costs in Austin present another substantial expense that many buyers underestimate. Texas law requires homeowners insurance for properties with mortgages, but Austin’s unique geographic and climatic conditions drive insurance costs higher than many buyers anticipate. The city’s location in “Flash Flood Alley” and its position as the only major urban center in Texas built on a floodplain create elevated risks that insurance companies factor into their pricing. Standard homeowners insurance policies typically exclude flood damage, requiring separate flood insurance for comprehensive protection.

Flood insurance costs vary dramatically based on the property’s location within Austin’s flood zones. Properties in high-risk areas (100-year floodplains) may require flood insurance as a condition of mortgage approval, with annual premiums ranging from $400 to $2,000 or more, depending on the property’s elevation, construction type, and coverage amount. Even properties outside designated flood zones may benefit from flood insurance, as the National Flood Insurance Program reports that approximately 25% of flood claims come from properties in low-to-moderate risk areas. Given that even one inch of water in a home can cause more than $25,000 in damage, this insurance represents a crucial but often overlooked expense.

Homeowners association (HOA) fees add another layer of monthly costs that vary widely across Austin’s diverse neighborhoods. While some areas have no HOA requirements, others—particularly newer developments and condominiums—may charge monthly fees ranging from $50 to $500 or more. These fees typically cover common area maintenance, amenities, and sometimes utilities, but they represent a permanent addition to housing costs that many buyers fail to factor into their budget calculations. Additionally, HOA fees tend to increase over time, and special assessments for major repairs or improvements can create unexpected financial burdens.

Utility costs in Austin reflect both the city’s climate and its municipal utility structure. Austin Energy provides electricity to most of the city, with rates that fluctuate based on usage and seasonal demand. Summer cooling costs can be substantial, with many homeowners seeing electric bills of $200 to $400 per month during peak summer periods. Water and wastewater services, provided by the City of Austin for most properties, include both usage charges and various fees that can add $100 to $200 to monthly expenses. Trash and recycling services, while included in some neighborhoods, may require separate contracts in others, adding another $30 to $50 monthly.

Maintenance and repair costs in Austin carry unique considerations related to the city’s climate, soil conditions, and construction characteristics. The area’s expansive clay soil, which shrinks and swells with moisture changes, can cause foundation issues that require ongoing monitoring and occasional expensive repairs. Many Austin homes, particularly those built before modern foundation techniques, experience foundation settlement that may require professional attention costing thousands of dollars. Additionally, the city’s rapid growth has strained infrastructure, leading to more frequent water line breaks and utility disruptions that can impact individual properties.

The age and style of many Austin homes also influence maintenance costs. The city’s character neighborhoods feature homes built in various eras, from early 20th-century bungalows to mid-century modern designs to contemporary constructions. Older homes, while often possessing charm and character that buyers find appealing, may require more frequent and expensive maintenance. Issues such as outdated electrical systems, aging plumbing, original windows that lack energy efficiency, and roofing materials that may not meet current standards can create ongoing expenses that significantly impact the total cost of ownership.

Austin’s rapid growth and development also create unique costs related to infrastructure improvements and municipal services. The city regularly implements special assessments for street improvements, sidewalk installations, and utility upgrades that can result in one-time charges of several thousand dollars for affected property owners. While these improvements typically enhance property values over time, they represent immediate costs that can strain budgets unprepared for such expenses.

Climate-related maintenance costs deserve special attention in Austin’s environment. The city’s hot summers and occasional severe weather events, including hailstorms and high winds, can accelerate wear on roofing, siding, and outdoor equipment. Air conditioning systems work harder and require more frequent maintenance and replacement than in milder climates. Landscaping and irrigation systems, essential for maintaining property values in Austin’s competitive market, require ongoing investment and water costs that can be substantial during drought periods.

Smart Austin homebuyers should budget for total housing costs that include not just the mortgage payment but also property taxes, insurance (both homeowners and flood), HOA fees, utilities, and a maintenance reserve of at least 1% to 2% of the home’s value annually. This comprehensive approach to budgeting ensures that homeownership enhances rather than strains financial stability, allowing buyers to enjoy their investment while building long-term wealth through real estate ownership in one of America’s most dynamic markets.

Mistake #3: Ignoring Flood Risks and Failing to Understand Austin’s Water Challenges

Austin’s relationship with water represents one of the most critical yet frequently overlooked aspects of homebuying in the area. As the only major urban center in Texas built on a floodplain and situated in the heart of “Flash Flood Alley,” Austin presents flood risks that many buyers either don’t understand or choose to ignore until it’s too late. This mistake can result in catastrophic financial losses, ongoing stress, and property damage that fundamentally alters the homeownership experience. The city’s unique geography, combined with increasingly unpredictable weather patterns, makes flood risk assessment an essential component of any responsible home purchase decision.

Austin’s position in Flash Flood Alley stems from its location where the Hill Country meets the coastal plains, creating topographical conditions that can transform minor rainfall events into dangerous flooding situations within minutes. The city sits atop the Edwards Aquifer, a massive underground water system that extends from Austin to San Antonio, creating complex groundwater dynamics that influence both flooding patterns and foundation stability. Additionally, Austin’s rapid development has altered natural drainage patterns, sometimes creating new flood risks in areas that were previously considered safe.

The Colorado River, which flows through the heart of Austin and provides the city’s primary water supply, has a complex history of flooding that continues to influence modern development patterns. Historical attempts to control the river through dam construction in the 1800s and early 1900s often failed catastrophically, with dam failures causing devastating floods that claimed lives and destroyed property throughout the city. While modern dam systems have improved significantly, the river’s flood potential remains a factor that influences property values and insurance requirements throughout the Austin metropolitan area.

Understanding Austin’s flood zone designations requires more sophistication than simply checking whether a property lies within a mapped floodplain. The Federal Emergency Management Agency (FEMA) designates flood zones based on statistical analysis of historical flooding patterns, but these maps may not reflect recent development changes, climate pattern shifts, or localized drainage issues that can create flood risks in supposedly safe areas. Properties in the 100-year floodplain (areas with a 1% annual chance of flooding) face the highest risk and typically require flood insurance as a condition of mortgage approval. However, properties in the 500-year floodplain or even outside designated flood zones can still experience flooding under certain conditions.

The city of Austin has developed FloodPro, a sophisticated online tool that allows property owners and prospective buyers to evaluate flood risks for specific addresses. This tool provides more detailed and current information than basic FEMA flood maps, incorporating local drainage studies, recent development impacts, and historical flood data specific to Austin’s unique conditions. Smart buyers use FloodPro in conjunction with professional flood risk assessments to understand not just current flood zone designations but also potential future risks as development patterns and climate conditions continue to evolve.

Flash flooding presents the most immediate and dangerous flood risk in Austin. Unlike river flooding, which typically develops over hours or days and provides some warning time, flash floods can occur within minutes of rainfall beginning. Austin’s topography, with numerous creeks and drainage channels running through developed areas, creates conditions where a sudden downpour can transform dry creek beds into raging torrents that can sweep away vehicles and threaten structures. Areas near Shoal Creek, Waller Creek, Barton Creek, and other waterways require particular attention, as these areas have experienced repeated flash flooding events that have caused property damage and threatened lives.

Groundwater flooding represents another unique challenge in Austin that many buyers fail to consider. The city’s position over the Edwards Aquifer means that heavy rainfall can cause groundwater levels to rise rapidly, leading to flooding that emerges from below ground rather than from surface water sources. This type of flooding can affect properties that appear to be well-drained and far from surface water sources, making it particularly difficult to predict without professional assessment. Groundwater flooding can cause foundation problems, basement flooding, and septic system failures that create both immediate damage and long-term structural issues.

The financial implications of flood damage extend far beyond the immediate costs of cleanup and repair. Even minor flooding can cause tens of thousands of dollars in damage, while major flood events can result in total property loss. Standard homeowners insurance policies specifically exclude flood damage, meaning that property owners without separate flood insurance face the full cost of flood-related repairs and replacement. The National Flood Insurance Program provides coverage for properties in participating communities, but coverage limits may not fully protect high-value properties, and the claims process can be lengthy and complex.

Flood insurance costs vary dramatically based on the property’s flood risk designation, elevation, and construction characteristics. Properties in high-risk areas may face annual premiums of $1,000 to $3,000 or more, while properties in moderate-to-low risk areas might obtain coverage for $400 to $800 annually. However, these costs pale in comparison to the potential financial devastation of uninsured flood damage. The National Flood Insurance Program reports that just one inch of water in a home can cause more than $25,000 in damage, making flood insurance a crucial consideration for any Austin property owner.

Beyond insurance considerations, flood risks influence property values, resale potential, and quality of life. Properties with documented flood histories often sell for less than comparable properties without such histories, and buyers may face challenges obtaining financing for properties in high-risk flood zones. Additionally, the stress and disruption caused by flood events—even minor ones—can significantly impact the enjoyment of homeownership and create ongoing anxiety about weather conditions and seasonal rainfall patterns.

Austin’s rapid development continues to alter flood patterns throughout the metropolitan area. New construction, particularly large-scale developments that replace natural vegetation with impervious surfaces, can increase runoff and alter drainage patterns in ways that affect neighboring properties. Buyers should investigate not only current flood risks but also planned development in their area that might influence future flood patterns. The city’s development review process includes flood impact assessments for major projects, but smaller developments may not receive the same level of scrutiny.

Climate change adds another layer of uncertainty to flood risk assessment in Austin. Increasing frequency of extreme weather events, including both severe droughts and intense rainfall periods, may alter historical flooding patterns in ways that current flood maps don’t fully capture. Some climate scientists predict that Central Texas will experience more frequent and intense rainfall events, potentially increasing flood risks beyond historical norms. This uncertainty makes conservative flood risk assessment and comprehensive insurance coverage even more important for long-term property ownership success.

Prospective Austin homebuyers should conduct thorough flood risk assessments that go beyond basic FEMA flood map reviews. This assessment should include consultation with local insurance agents familiar with Austin’s flood risks, review of the property’s flood history through city records and neighbor interviews, evaluation of the property’s elevation relative to nearby water sources, and consideration of planned development that might affect drainage patterns. Additionally, buyers should budget for appropriate flood insurance coverage and consider flood mitigation measures such as proper grading, drainage improvements, and emergency preparedness plans.

The investment in comprehensive flood risk assessment and appropriate insurance coverage represents a small cost compared to the potential financial and emotional devastation of flood damage. In Austin’s unique environment, where water can transform from life-giving resource to destructive force within minutes, understanding and preparing for flood risks represents not just smart financial planning but essential protection for one of life’s most significant investments.

Mistake #4: Choosing the Wrong Neighborhood Without Understanding Austin’s Diverse Character

Austin’s neighborhood diversity represents both one of its greatest attractions and one of its most significant challenges for homebuyers. The city’s rapid growth and unique development patterns have created a metropolitan area where neighborhoods just miles apart can offer dramatically different lifestyles, amenities, costs, and long-term prospects. Buyers who fail to thoroughly research and understand these neighborhood differences often find themselves in areas that don’t match their lifestyle needs, commute requirements, or investment goals, leading to dissatisfaction and potential financial losses when they attempt to relocate.

The phrase “Keep Austin Weird” reflects more than just a marketing slogan—it captures the city’s commitment to maintaining distinct neighborhood identities even as rapid growth threatens to homogenize the metropolitan area. From the historic charm of Hyde Park and Clarksville to the emerging energy of East Austin and the suburban appeal of Cedar Park and Round Rock, each area offers unique advantages and challenges that require careful consideration. Understanding these differences becomes crucial when considering that Austin’s size and traffic patterns can make relocating within the city both expensive and disruptive.

Central Austin neighborhoods like Zilker, South Lamar, and the areas surrounding Lady Bird Lake offer the quintessential Austin experience with walkable access to the city’s famous music venues, restaurants, and outdoor activities. These areas command premium prices, with median home values often exceeding $700,000 to $1 million, but they provide the lifestyle that many people associate with Austin living. However, buyers attracted to these neighborhoods must understand that the benefits come with trade-offs including higher property taxes, limited parking, increased noise levels, and the ongoing challenges of living in areas experiencing rapid development and gentrification.

East Austin has undergone perhaps the most dramatic transformation of any area in the city, evolving from an affordable, predominantly minority community to one of the hottest real estate markets in Texas. Neighborhoods like East Cesar Chavez, Holly, and Govalle now feature trendy restaurants, art galleries, and music venues alongside rapidly appreciating home values. However, this transformation has created complex social and economic dynamics that buyers must understand. Gentrification has displaced many long-term residents, created tension between newcomers and established communities, and resulted in rapid property tax increases that can strain budgets. Additionally, some areas of East Austin still experience higher crime rates and may lack some of the infrastructure and amenities found in more established neighborhoods.

South Austin maintains much of the city’s counterculture identity while offering more affordable housing options than central neighborhoods. Areas like Barton Hills, Bouldin Creek, and parts of South Lamar provide access to Austin’s cultural amenities while maintaining a more relaxed, residential character. However, South Austin’s popularity has driven significant price appreciation, and traffic congestion on major arteries like South Lamar Boulevard and Barton Springs Road can make commuting challenging. Additionally, some South Austin neighborhoods face flood risks from Barton Creek and other waterways that require careful evaluation.

North Austin presents a diverse mix of established neighborhoods and emerging areas that offer various price points and lifestyle options. Areas like Crestview, Brentwood, and parts of North Shoal Creek provide more affordable access to central Austin amenities while maintaining distinct neighborhood characters. However, North Austin’s development patterns can be inconsistent, with well-maintained areas adjacent to properties that may need significant investment. Additionally, some North Austin neighborhoods lack the walkability and amenities that many Austin buyers seek, requiring more reliance on automobile transportation.

The suburban communities surrounding Austin—including Cedar Park, Round Rock, Pflugerville, and Leander—offer newer construction, larger lots, better schools, and more affordable housing options compared to central Austin. These areas appeal particularly to families seeking space, safety, and access to highly-rated school districts. However, suburban living in the Austin area requires careful consideration of commute times and transportation costs. Traffic congestion on major highways like I-35, MoPac (Loop 1), and US 183 can make commuting to central Austin time-consuming and stressful, particularly during peak hours. Additionally, suburban areas may lack the cultural amenities and walkable lifestyle that attract many people to Austin.

School district considerations add another layer of complexity to Austin neighborhood selection. The Austin Independent School District (AISD) serves much of central Austin but faces challenges including funding constraints, aging facilities, and achievement gaps that vary significantly between schools. Some AISD schools, particularly in affluent areas, perform exceptionally well and are highly sought after, while others struggle with resources and outcomes. Suburban districts like Round Rock ISD, Leander ISD, and Eanes ISD generally offer more consistent performance and newer facilities but may lack the diversity and cultural richness found in AISD schools.

Transportation infrastructure significantly influences neighborhood desirability and long-term value prospects in Austin. The city’s ongoing transportation challenges, including limited public transit options and increasing traffic congestion, make proximity to major employment centers and transportation corridors crucial considerations. Areas near major tech employers like Apple, Google, and Facebook may offer shorter commutes but also face increased development pressure and rising costs. Conversely, neighborhoods farther from employment centers may offer more affordable housing but require longer commutes that can significantly impact quality of life and transportation costs.

Austin’s rapid growth continues to alter neighborhood dynamics in ways that can affect long-term property values and livability. Areas experiencing significant development may see improved amenities and infrastructure but also face construction disruption, increased density, and changing character that may not align with buyers’ expectations. Conversely, neighborhoods that resist development may maintain their character but could miss opportunities for infrastructure improvements and amenity enhancements that support property values.

The city’s ongoing efforts to address housing affordability through zoning changes and development incentives will continue to influence neighborhood evolution. Recent changes allowing accessory dwelling units (ADUs) in many neighborhoods and efforts to increase density along transit corridors may alter the character and property values of established areas. Buyers should understand these policy trends and their potential impacts on their chosen neighborhoods.

Climate and environmental factors also vary significantly between Austin neighborhoods. Areas closer to Lady Bird Lake and other water sources may experience more humidity and different microclimates than neighborhoods on higher ground. Tree coverage, which varies dramatically across the city, influences both energy costs and quality of life. Neighborhoods with mature tree canopies typically offer lower cooling costs and more pleasant outdoor environments but may face higher maintenance costs and potential storm damage risks.

Crime rates and safety considerations vary substantially across Austin neighborhoods, requiring careful research beyond general city statistics. Some areas experience property crime issues related to their proximity to entertainment districts or major roadways, while others maintain very low crime rates. Buyers should review neighborhood-specific crime data, talk to local residents, and visit areas at different times of day and week to understand safety dynamics.

Future development plans and infrastructure projects can significantly impact neighborhood desirability and property values. Major projects like transportation improvements, park developments, or commercial centers can enhance areas but may also bring construction disruption and increased traffic. Conversely, undesirable developments like industrial facilities or major roadway expansions can negatively impact residential areas. Buyers should research planned developments and infrastructure projects that might affect their chosen neighborhoods.

Successful Austin homebuyers invest significant time in neighborhood research that goes beyond online searches and brief visits. This research should include multiple visits at different times and days, conversations with current residents, review of local crime statistics and school performance data, evaluation of commute times during peak hours, assessment of walkability and access to amenities, and consideration of long-term development trends. This comprehensive approach ensures that buyers choose neighborhoods that will support their lifestyle goals and provide strong long-term investment potential in Austin’s dynamic and evolving metropolitan area.

Mistake #5: Skipping Professional Home Inspections or Choosing Inadequate Inspection Services

The decision to forgo a professional home inspection or to select an inadequate inspection service represents one of the most financially dangerous mistakes Austin homebuyers can make. Austin’s unique construction challenges, including expansive clay soil that causes foundation issues, diverse architectural styles spanning more than a century, and rapid construction during boom periods that sometimes prioritized speed over quality, create conditions where thorough professional inspection becomes essential for protecting what is likely the largest investment most people will ever make.

Austin’s geological conditions create foundation challenges that are virtually unknown in many other parts of the country. The area’s expansive clay soil, known locally as “black gumbo,” shrinks dramatically during dry periods and swells substantially when wet. This constant expansion and contraction cycle places enormous stress on home foundations, particularly those built before modern foundation engineering techniques became standard. Many Austin homes, especially those built before the 1980s, experience foundation settlement, cracking, and movement that can range from minor cosmetic issues to major structural problems requiring tens of thousands of dollars in repairs.

A qualified home inspector familiar with Austin’s soil conditions can identify foundation issues that untrained buyers might miss or dismiss as minor concerns. Signs of foundation problems include cracks in walls or ceilings, doors and windows that stick or don’t close properly, uneven floors, and gaps between walls and ceilings or floors. However, these symptoms can be subtle, and their significance may not be apparent to buyers without construction experience. Professional inspectors use specialized tools and techniques to assess foundation conditions and can distinguish between minor settling that requires monitoring and serious problems that demand immediate attention.

The diversity of Austin’s housing stock creates additional inspection challenges that require specialized knowledge and experience. The city features everything from 1920s bungalows and 1950s ranch homes to contemporary custom constructions and high-density condominiums. Each architectural style and construction era presents unique potential problems that generic inspection approaches might miss. For example, homes built in the 1960s and 1970s often feature electrical systems that don’t meet current safety standards, while newer constructions might have issues related to rapid building during boom periods when qualified contractors were in short supply.

Austin’s climate creates specific maintenance and durability challenges that require expert evaluation. The city’s hot summers place enormous demands on air conditioning systems, while occasional severe weather events including hailstorms and high winds can damage roofing, siding, and outdoor equipment. Additionally, the area’s humidity levels can contribute to mold and moisture problems, particularly in homes with inadequate ventilation or moisture control systems. A thorough inspection should evaluate not just current conditions but also the systems and features that will influence long-term maintenance costs and comfort.

The rapid pace of construction during Austin’s recent growth periods has created quality control issues that make professional inspection even more critical. During peak building periods, the shortage of qualified contractors and construction workers led to some developments where speed took precedence over quality. Issues such as improper installation of HVAC systems, inadequate insulation, poor drainage around foundations, and substandard electrical or plumbing work may not be immediately apparent but can create significant problems and expenses for homeowners. Professional inspectors trained to identify these issues can save buyers from purchasing properties with hidden defects that could cost thousands of dollars to correct.

Austin’s older neighborhoods present unique inspection challenges related to aging infrastructure and systems that may not meet current safety and efficiency standards. Many charming older homes feature original electrical systems that lack adequate capacity for modern appliances and electronics, plumbing systems that may include outdated materials like galvanized steel or cast iron, and insulation that doesn’t meet current energy efficiency standards. While these issues don’t necessarily disqualify a property, understanding their scope and cost implications allows buyers to make informed decisions and budget appropriately for necessary upgrades.

The inspection process should extend beyond the home’s interior to include evaluation of drainage, grading, and landscaping that can influence foundation stability and flood risk. Austin’s topography and drainage patterns mean that seemingly minor grading issues can direct water toward foundations or create standing water that contributes to foundation problems or flooding. Professional inspectors evaluate not just current drainage conditions but also potential issues that might develop as landscaping matures or as nearby development alters water flow patterns.

Specialized inspections may be necessary for certain types of Austin properties or specific concerns. Pool and spa inspections are crucial for properties with these amenities, as Austin’s climate and water chemistry can create unique maintenance challenges. Septic system inspections are essential for properties outside municipal sewer service areas, particularly given the area’s soil conditions and groundwater characteristics. Additionally, properties in flood-prone areas may benefit from specialized flood risk assessments that go beyond basic FEMA flood map reviews.

The timing of inspections within the purchase process requires careful coordination to maximize their value while respecting contract deadlines. Texas real estate contracts typically include inspection periods that allow buyers to conduct evaluations and negotiate repairs or price adjustments based on inspection findings. However, these periods are often limited to seven to ten days, requiring prompt scheduling and completion of inspection services. Buyers should arrange inspections immediately upon contract execution and should be present during the inspection to ask questions and understand the inspector’s findings firsthand.

Choosing the right inspection service requires research and careful evaluation of qualifications and experience. Texas requires home inspectors to be licensed, but licensing represents only minimum qualifications. Buyers should seek inspectors with specific experience in Austin’s market, knowledge of local construction practices and challenges, and strong reputations among local real estate professionals. Professional associations such as the American Society of Home Inspectors (ASHI) or the International Association of Certified Home Inspectors (InterNACHI) provide additional credentialing that indicates commitment to ongoing education and professional standards.

The cost of professional inspection services, typically ranging from $400 to $800 for most Austin homes, represents a minimal investment compared to the potential costs of undiscovered problems. Buyers who attempt to save money by skipping inspections or choosing the lowest-cost provider often face much larger expenses when hidden problems emerge after closing. Additionally, inspection reports provide valuable documentation for insurance purposes and future maintenance planning, making them useful long after the purchase transaction is complete.

Buyers should understand that home inspections have limitations and may not identify every potential problem, particularly issues that are hidden behind walls or that develop over time. However, professional inspections provide the best available assessment of a property’s current condition and help buyers make informed decisions about their purchase. The inspection process also provides an opportunity for buyers to learn about their potential new home’s systems and maintenance requirements, information that proves valuable for long-term homeownership success.

In Austin’s competitive market, some buyers feel pressure to waive inspection contingencies to make their offers more attractive to sellers. This strategy, while potentially effective for winning bidding wars, dramatically increases the risk of purchasing a property with significant hidden problems. Buyers who choose this approach should consider pre-inspection services, where they conduct inspections before making an offer, or should ensure they have sufficient financial reserves to address any problems that emerge after closing.

The investment in comprehensive professional inspection services represents one of the most important protections Austin homebuyers can purchase. In a market where foundation problems, aging infrastructure, and construction quality issues can create substantial unexpected expenses, thorough inspection provides both peace of mind and financial protection that far exceeds its modest cost.

Mistake #6: Failing to Research Future Development and Infrastructure Changes

Austin’s explosive growth trajectory makes understanding future development and infrastructure plans essential for making sound real estate investment decisions. The city’s population has increased by more than 20% in the past decade, with projections suggesting continued rapid growth that will fundamentally alter neighborhoods, transportation patterns, and quality of life throughout the metropolitan area. Buyers who fail to research planned developments, infrastructure projects, and policy changes often find themselves in situations where their property values, daily routines, and neighborhood character change dramatically in ways they never anticipated.

The City of Austin’s comprehensive planning process, outlined in documents like the Austin Strategic Mobility Plan and various neighborhood planning initiatives, provides roadmaps for future development that can significantly impact property values and livability. These plans include major transportation projects, zoning changes, park developments, and infrastructure improvements that will reshape the city over the coming decades. However, accessing and interpreting these plans requires effort and expertise that many buyers don’t invest, leading to surprises that could have been anticipated with proper research.

Transportation infrastructure represents perhaps the most significant factor influencing Austin’s future development patterns and property values. The city’s ongoing efforts to address traffic congestion through projects like the I-35 expansion, MoPac improvements, and the Austin Transit Partnership’s Project Connect will create winners and losers among neighborhoods depending on their proximity to improved transportation options. Properties near planned transit stations or improved highway access may see substantial value appreciation, while areas that become more isolated or experience increased traffic may face challenges.

Project Connect, Austin’s ambitious public transit expansion plan, includes light rail lines, bus rapid transit routes, and improved local bus service that will fundamentally alter transportation patterns throughout the metropolitan area. The Orange Line, connecting downtown Austin to Austin-Bergstrom International Airport, and the Blue Line, serving areas from downtown to the northwest, will create new development opportunities and change property values along their routes. However, construction of these transit lines will also create years of disruption, noise, and access challenges for nearby properties that buyers should understand before purchasing.

The ongoing I-35 expansion project through central Austin represents one of the most significant infrastructure undertakings in the city’s history. While the project aims to reduce traffic congestion and improve connectivity between East and West Austin, the construction process will create years of disruption for nearby properties. Additionally, the project’s design and implementation may influence development patterns and property values in ways that are difficult to predict. Properties near the construction zone may experience noise, dust, and access challenges, while the completed project may alter traffic patterns and neighborhood connectivity in significant ways.

Austin’s rapid growth has strained municipal services and infrastructure in ways that require ongoing investment and expansion. Water and wastewater systems, electrical grid capacity, emergency services, and schools all face challenges related to serving a rapidly growing population. The city’s capital improvement plans outline billions of dollars in infrastructure investments over the coming decades, funded through bonds and other mechanisms that will influence property taxes and service quality. Understanding these plans helps buyers anticipate both the benefits of improved services and the costs of financing necessary improvements.

Zoning changes and land use policy modifications represent another category of future changes that can dramatically impact property values and neighborhood character. Austin’s ongoing efforts to address housing affordability through zoning reforms, including allowing accessory dwelling units (ADUs) in more neighborhoods and increasing density along transit corridors, will alter the character of many established residential areas. While these changes may increase property values by allowing more intensive use of land, they may also change neighborhood character in ways that some residents find undesirable.

The CodeNEXT initiative, Austin’s comprehensive effort to rewrite its land development code, has created uncertainty about future development patterns throughout the city. While the specific outcomes of this process remain unclear, the changes will likely influence where and how development occurs, potentially affecting property values and neighborhood character in significant ways. Buyers should understand the current zoning of their potential properties and the likelihood of future changes that might affect their investment.

Private development projects can also significantly impact nearby properties in ways that require advance research. Major commercial developments, apartment complexes, or office buildings can bring both benefits and challenges to surrounding neighborhoods. Increased traffic, noise, and density may negatively impact residential areas, while improved amenities and services may enhance property values. Additionally, large-scale residential developments can alter neighborhood demographics and character while potentially straining local infrastructure and services.

Austin’s technology sector growth continues to drive development patterns throughout the metropolitan area. Major employers like Apple, Google, Facebook, and Tesla are establishing or expanding significant operations in the Austin area, creating employment centers that will influence transportation patterns and housing demand. Understanding where these employment centers are located and how they might expand helps buyers anticipate future traffic patterns, development pressures, and property value trends.

Environmental considerations add another layer of complexity to Austin’s future development patterns. Climate change impacts, including increased frequency of extreme weather events and potential changes in water availability, may influence development policies and infrastructure investments. Additionally, environmental protection efforts related to water quality, air quality, and habitat preservation may limit development in certain areas while directing growth to others.

The city’s park and recreation master plan outlines significant investments in green space and recreational facilities that can enhance property values and quality of life. Major projects like the Violet Crown Trail, improvements to existing parks, and creation of new recreational facilities provide amenities that make nearby properties more desirable. However, these projects also require funding that may influence property taxes and may create construction disruption during implementation.

School district planning and capacity issues represent crucial considerations for families and investors in Austin’s growing market. Rapid population growth has strained school capacity throughout the metropolitan area, leading to boundary changes, new school construction, and potential overcrowding issues. Understanding school district plans and capacity constraints helps buyers anticipate potential changes that might affect their children’s education or their property’s resale value.

Utility infrastructure planning, including electrical grid improvements, water system expansions, and telecommunications infrastructure, influences both property values and quality of life. Austin Energy’s resource plan outlines the transition to renewable energy sources and grid modernization efforts that may affect utility costs and reliability. Similarly, water utility planning addresses capacity constraints and infrastructure improvements necessary to serve a growing population.

Research into future development and infrastructure changes requires accessing multiple information sources and understanding complex planning documents. The City of Austin’s website provides access to comprehensive plans, zoning maps, and development applications, while neighborhood associations and local news sources often provide more accessible summaries of planned changes. Additionally, real estate professionals with local expertise can provide insights into development trends and their potential impacts.

Buyers should also consider the political and economic factors that influence development patterns and infrastructure investments. Austin’s political climate, state-level policies affecting local government, and economic conditions all influence the likelihood that planned projects will be completed as envisioned. Understanding these broader factors helps buyers assess the probability that anticipated changes will actually occur and their potential timeline.

The investment in researching future development and infrastructure changes provides buyers with crucial information for making informed decisions about property purchases. In Austin’s rapidly evolving environment, understanding what changes are planned and how they might affect specific properties can mean the difference between a successful long-term investment and an unfortunate surprise that diminishes both property values and quality of life.

Mistake #7: Making Emotional Decisions and Abandoning Financial Discipline

The emotional intensity of homebuying in Austin’s dynamic market often leads buyers to abandon the financial discipline and rational decision-making that should guide such a significant investment. While the market has cooled from the frenzied pace of recent years, Austin’s desirable properties still generate emotional responses that can cloud judgment and lead to decisions that buyers later regret. The combination of Austin’s unique character, competitive market dynamics, and the natural emotional investment in finding a “home” rather than just a house creates conditions where even experienced buyers can make costly mistakes driven by emotion rather than sound financial analysis.

Austin’s distinctive neighborhoods and architectural styles often trigger powerful emotional responses that can override practical considerations. The charm of a 1920s bungalow in Hyde Park, the modern appeal of a contemporary home in Barton Hills, or the historic character of a restored Victorian in Clarksville can create immediate emotional connections that make buyers feel they’ve found “the one.” This emotional attachment, while natural and often positive, becomes dangerous when it leads buyers to overlook significant problems, stretch beyond their financial means, or make hasty decisions without proper due diligence.

The scarcity mindset that developed during Austin’s recent seller’s market continues to influence buyer behavior even as market conditions have become more balanced. Many buyers still operate under the assumption that desirable properties will disappear immediately if they don’t act quickly, leading to rushed decisions and inadequate research. While some properties in prime locations or unique circumstances may still move quickly, the current market with 15,796 active listings and a months of inventory at 5.65 provides buyers with more time and options than they’ve had in years.

Financial discipline becomes particularly challenging in Austin’s market because of the wide range of price points and the temptation to stretch budgets for properties in more desirable areas. A buyer with a $400,000 budget might find adequate housing in suburban areas but feel tempted to increase their budget to $500,000 or more to access central Austin neighborhoods. This budget stretching often seems manageable when considering only the monthly mortgage payment difference, but it can create financial stress when combined with Austin’s high property taxes, insurance costs, and maintenance expenses.

The pre-approval process, while essential, can also contribute to emotional decision-making if buyers interpret their maximum approved loan amount as their target budget rather than their absolute limit. Lenders approve buyers for loan amounts based on debt-to-income ratios that may not account for individual lifestyle preferences, savings goals, or unexpected expenses. Smart buyers establish their own budget based on comprehensive analysis of their financial situation and stick to it regardless of their maximum loan approval amount.

Austin’s rapid price appreciation in recent years has created a fear of missing out (FOMO) mentality that persists even as market conditions have stabilized. Buyers worry that if they don’t purchase immediately, prices will continue rising and they’ll be priced out of their desired areas. However, current market data suggests that Austin home prices are stabilizing or even declining slightly, with forecasts predicting continued moderation over the next 18 to 24 months. This environment actually favors patient buyers who can take time to find the right property at the right price rather than rushing into decisions based on fear.

The emotional appeal of Austin’s lifestyle and culture can also lead buyers to prioritize location and character over practical considerations like commute times, maintenance costs, and long-term financial implications. A buyer might fall in love with a property near South Lamar’s restaurants and music venues without fully considering the impact of tourist traffic, parking challenges, and noise levels on daily life. Similarly, the charm of an older home in an established neighborhood might overshadow the reality of ongoing maintenance costs and potential major repairs.

Bidding wars, while less common than during peak market conditions, still occur for particularly desirable properties and can trigger emotional responses that lead to poor financial decisions. The competitive dynamic of bidding against other buyers can create an auction mentality where winning becomes more important than making a sound financial decision. Buyers may find themselves increasing their offers beyond their planned budget or waiving important contingencies like inspections or appraisals to make their offers more competitive.

The current market environment, with its New Listing to Pending Ratio of 0.53 and average days on market of 78 days, actually provides buyers with more negotiating power and time for careful consideration than they’ve had in recent years. However, many buyers haven’t adjusted their strategies to take advantage of these improved conditions, continuing to operate with the urgency and compromise mentality that was necessary during the seller’s market.

Social media and online real estate platforms can exacerbate emotional decision-making by creating unrealistic expectations and encouraging comparison shopping that focuses on superficial features rather than fundamental value. Buyers may become fixated on properties they see online without understanding their true condition, neighborhood context, or market value. Additionally, the constant exposure to “dream homes” and luxury properties can create dissatisfaction with realistic options within their budget range.

The involvement of family and friends in the homebuying process, while often well-intentioned, can add emotional pressure that interferes with rational decision-making. Parents who want to help their children buy homes, friends who share opinions about neighborhoods or properties, and social pressure to achieve homeownership milestones can all influence buyers to make decisions that don’t align with their financial capabilities or lifestyle needs.

Establishing and maintaining financial discipline requires clear budget parameters, objective evaluation criteria, and the willingness to walk away from properties that don’t meet established standards. Successful Austin buyers create written criteria for their home search that include maximum price limits, required features, acceptable neighborhoods, and deal-breaker conditions. They refer to these criteria throughout their search process and resist the temptation to modify them based on emotional responses to specific properties.

The cooling market conditions also provide opportunities for buyers to negotiate not just on price but on terms that can improve their financial position. Sellers may be willing to contribute to closing costs, provide home warranties, or address repair issues identified during inspections. Buyers who maintain emotional discipline can take advantage of these opportunities rather than feeling grateful just to have an offer accepted.

Professional guidance from experienced real estate agents, mortgage lenders, and financial advisors can help buyers maintain perspective and avoid emotional decision-making. These professionals can provide objective analysis of properties and market conditions, helping buyers understand when they’re considering decisions based on emotion rather than sound financial analysis. However, buyers must be willing to listen to professional advice even when it conflicts with their emotional preferences.

The long-term financial implications of emotional homebuying decisions extend far beyond the initial purchase. Buyers who stretch their budgets or compromise their standards may find themselves unable to afford necessary maintenance, improvements, or lifestyle expenses. They may also find themselves trapped in properties that don’t meet their needs but that they can’t afford to leave due to transaction costs and financial constraints.

Successful homebuying in Austin requires balancing the emotional satisfaction of finding a home that feels right with the financial discipline necessary to make a sound investment. The current market conditions provide buyers with the time and opportunity to find properties that meet both their emotional and financial needs, but only if they resist the temptation to make hasty decisions based on fear, competition, or superficial attraction. Maintaining this balance ensures that the excitement of buying a home in Austin doesn’t become the regret of making a decision that strains finances or fails to meet long-term needs.

Mistake #8: Not Working with Experienced Local Real Estate Professionals

The complexity of Austin’s real estate market, combined with its unique challenges and rapidly evolving conditions, makes working with experienced local professionals essential for successful homebuying. Many buyers, particularly those relocating from other markets or first-time purchasers, underestimate the value of professional guidance or choose agents based on factors like commission rates or personal relationships rather than local expertise and market knowledge. This mistake can result in missed opportunities, overpaying for properties, inadequate protection during the transaction process, and failure to navigate Austin’s specific challenges effectively.

Austin’s real estate market differs significantly from other major Texas cities and national markets in ways that require specialized knowledge and experience. The city’s unique geography, including its position on a floodplain and in Flash Flood Alley, creates risks and considerations that agents from other markets may not understand. Additionally, Austin’s rapid growth, diverse neighborhood characteristics, and complex regulatory environment require local expertise that generic real estate knowledge cannot provide. An agent who successfully sells homes in Dallas, Houston, or other markets may lack the specific insights necessary to guide Austin buyers effectively.

The current market transition from a seller’s market to more balanced conditions requires agents who understand how to adapt strategies and advice to changing circumstances. Many agents built their practices during Austin’s recent boom years when properties sold quickly and buyers had limited negotiating power. The current environment, with increased inventory, longer days on market, and more buyer leverage, requires different approaches to pricing, negotiations, and transaction management that not all agents have mastered.

Local market knowledge extends beyond general statistics to include neighborhood-specific insights that can significantly impact buying decisions. Experienced Austin agents understand the subtle differences between areas that might appear similar to outsiders, such as the distinction between different sections of East Austin or the varying characteristics of North Austin neighborhoods. They know which areas are experiencing gentrification, which neighborhoods have the best schools, where traffic patterns create commute challenges, and how local development plans might affect future property values.

Understanding Austin’s regulatory environment and municipal processes requires local expertise that can save buyers time, money, and frustration. The city’s permitting processes, zoning regulations, and development review procedures can affect everything from simple home improvements to major renovations. Experienced local agents understand these processes and can advise buyers about potential limitations or opportunities related to their property choices. They also understand local disclosure requirements, inspection standards, and contract provisions that may differ from other markets.

The network of local service providers that experienced Austin agents maintain provides significant value throughout the buying process and beyond. These agents have relationships with inspectors who understand Austin’s specific challenges, lenders familiar with local market conditions and programs, contractors experienced with the area’s construction issues, and other professionals who can provide specialized services. This network becomes particularly valuable when dealing with Austin-specific issues like foundation problems, flood risks, or historic property considerations.

Negotiation strategies in Austin’s market require understanding of local customs, seller motivations, and market dynamics that vary significantly from other areas. Experienced local agents understand how to structure offers that appeal to Austin sellers, what contingencies are standard and acceptable, and how to navigate the negotiation process effectively. They also understand when market conditions favor aggressive offers versus when buyers can negotiate more favorable terms.

The importance of local expertise becomes particularly apparent when dealing with Austin’s unique property types and challenges. The city’s diverse housing stock includes everything from historic homes with preservation restrictions to new construction in master-planned communities to unique properties like converted warehouses or contemporary designs. Each property type presents specific considerations for financing, insurance, maintenance, and resale that require specialized knowledge.

Austin’s rapid growth has also created a market where many agents are relatively new to the area or the profession, making it crucial for buyers to verify their agents’ local experience and track record. The influx of new residents and real estate professionals means that not everyone claiming local expertise actually possesses the deep knowledge necessary to guide buyers effectively. Buyers should research their agents’ backgrounds, ask about their experience with specific neighborhoods or property types, and request references from recent clients.

The current market conditions also require agents who understand how to use technology and data effectively while maintaining the personal service that complex transactions demand. Austin’s market data changes rapidly, and agents need access to current information about pricing trends, inventory levels, and market dynamics. However, they also need the experience and judgment to interpret this data correctly and provide guidance that goes beyond what buyers can find through online research.

Buyer representation agreements and agent compensation structures require careful consideration in Austin’s market. While buyers don’t typically pay agent commissions directly, they should understand how their agents are compensated and ensure that their interests are properly aligned. Experienced agents should be able to explain their services clearly, provide references, and demonstrate their value through market knowledge and professional competence rather than just promising to rebate portions of their commission.

The transaction management process in Austin involves numerous local service providers, municipal departments, and regulatory requirements that can create delays or complications for unprepared buyers. Experienced local agents understand these processes and can help buyers navigate them efficiently while avoiding common pitfalls. They know which lenders process loans quickly, which title companies provide reliable service, and how to coordinate inspections and other services within tight timeframes.

Post-closing support represents another area where experienced local agents provide ongoing value. Austin’s rapid growth and changing conditions mean that new homeowners often need guidance about everything from utility connections and municipal services to contractor recommendations and neighborhood resources. Agents with strong local networks and ongoing client relationships can provide this support long after the transaction closes.

The selection process for real estate agents should focus on local experience, market knowledge, and professional competence rather than personal relationships or commission considerations. Buyers should interview multiple agents, ask specific questions about their Austin experience and market knowledge, request references from recent clients, and evaluate their communication skills and responsiveness. The agent selection decision significantly influences the entire homebuying experience and outcome.

Professional credentials and continuing education also indicate an agent’s commitment to maintaining current knowledge and skills. Designations from organizations like the National Association of Realtors, local real estate boards, and specialized training programs demonstrate ongoing professional development that benefits clients. Additionally, agents who participate in local real estate organizations and community activities often have better networks and market insights.

The value of experienced local representation becomes particularly apparent when problems arise during the transaction process. Austin’s unique challenges, from foundation issues discovered during inspections to flood insurance requirements to title complications related to the area’s development history, require agents who have dealt with these issues before and know how to resolve them effectively. Inexperienced agents may not recognize potential problems or may not know how to address them when they arise.

In Austin’s competitive and complex market, the decision to work with experienced local real estate professionals represents an investment in expertise that can save buyers significant time, money, and stress while helping them achieve better outcomes. The cost of professional representation is typically built into the transaction structure, making it essentially free to buyers while providing access to knowledge and services that would be difficult or impossible to obtain independently. Choosing the right professionals and utilizing their expertise effectively represents one of the most important decisions buyers can make in their Austin real estate journey.

Conclusion: Navigating Austin’s Real Estate Market Successfully

The Austin real estate market of 2025 presents both unprecedented opportunities and significant challenges for homebuyers willing to approach their purchase with knowledge, preparation, and strategic thinking. The market’s transition from the frenzied pace of recent years to more balanced conditions has created an environment where informed buyers can find excellent properties at reasonable prices, but only if they avoid the critical mistakes that continue to trap unprepared purchasers.

The eight mistakes outlined in this guide represent the most common and costly errors that Austin homebuyers make, each carrying the potential to transform what should be an exciting investment into a source of financial stress and regret. However, understanding these pitfalls provides buyers with the knowledge necessary to navigate Austin’s unique market successfully and build long-term wealth through real estate ownership in one of America’s most dynamic cities.

The current market conditions, with active listings at 15,796 units and months of inventory at 5.65, provide buyers with more leverage and time for careful decision-making than they’ve enjoyed in years. The median sales price of $450,000, down 3.2% year-over-year, combined with forecasts suggesting continued price moderation over the next 18 to 24 months, creates opportunities for buyers who approach their purchase strategically rather than reactively.

However, these improved market conditions don’t eliminate the need for careful preparation and informed decision-making. Austin’s unique challenges—from its position in Flash Flood Alley to its nation-leading property tax burden to its rapidly evolving neighborhood dynamics—require buyers to invest significant time and effort in research, planning, and professional guidance. The buyers who succeed in this market are those who treat their home purchase as both an emotional journey and a business transaction, maintaining the discipline to make decisions based on facts and financial analysis rather than fear or impulse.

The financial implications of avoiding these mistakes extend far beyond the initial purchase transaction. Buyers who secure proper pre-approval, accurately budget for total ownership costs, understand flood risks, choose appropriate neighborhoods, conduct thorough inspections, research future development plans, maintain emotional discipline, and work with experienced professionals position themselves for long-term success that includes not just homeownership satisfaction but also wealth building through real estate appreciation.

Austin’s continued growth and economic development suggest that well-chosen properties purchased with proper preparation will continue to provide both lifestyle benefits and investment returns over time. The city’s technology sector expansion, cultural attractions, and quality of life advantages ensure ongoing demand for housing, while the current market correction provides opportunities to purchase at more reasonable valuations than were available during peak market conditions.

The key to success lies in approaching the Austin market with respect for its complexity and commitment to thorough preparation. This means beginning the process with comprehensive financial planning and pre-approval, investing time in neighborhood research and property evaluation, assembling a team of experienced local professionals, and maintaining the discipline to make decisions based on long-term financial goals rather than short-term emotions or market pressures.

For buyers willing to invest the time and effort required to navigate Austin’s market successfully, the rewards include not just homeownership in one of America’s most desirable cities but also participation in a real estate market that has historically provided strong returns for informed investors. The current market conditions provide an excellent opportunity for buyers who approach their purchase with knowledge, preparation, and strategic thinking to achieve both their lifestyle and financial goals through Austin real estate ownership.

The mistakes outlined in this guide are entirely avoidable for buyers who commit to proper preparation and professional guidance. By understanding these pitfalls and taking proactive steps to avoid them, Austin homebuyers can transform what might otherwise be a stressful and costly experience into a successful investment that provides both immediate satisfaction and long-term financial benefits. In Austin’s dynamic and evolving market, knowledge truly represents the difference between success and regret, making the investment in proper preparation one of the most valuable decisions any buyer can make.

This article was prepared by Manus AI using current market data and analysis as of June 2025. Real estate markets change rapidly, and buyers should consult with local professionals for the most current information and personalized guidance.